do i have to pay tax on a foreign gift

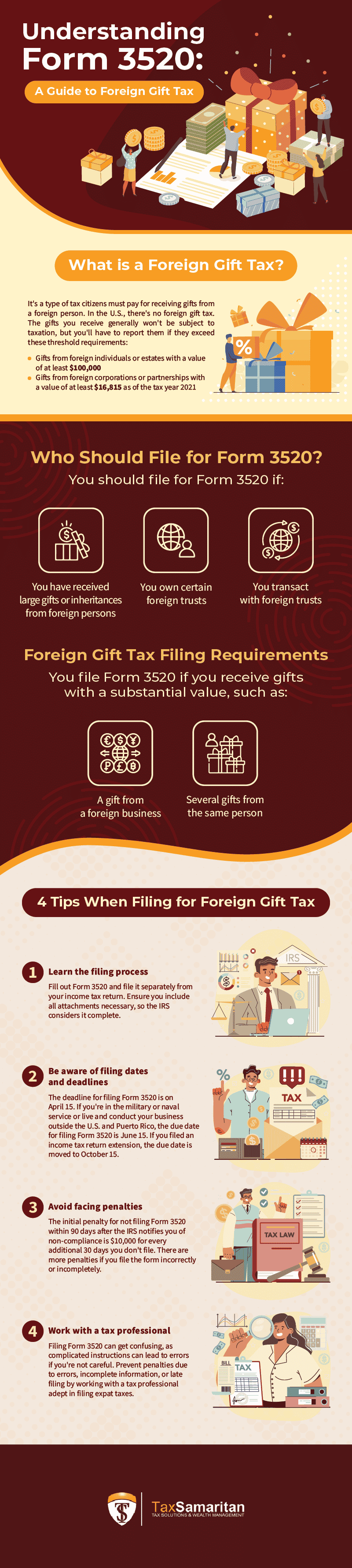

For purported gifts from foreign corporations or foreign partnerships you are required to report the receipt of such purported gifts only if the aggregate amount received from all entities. Person must r eport the Gift on Form 3520.

This value is adjusted.

. Further you must report foreign gifts from foreign corporations or foreign partnerships of more than 16649 as of tax year 2020 on Form 3520. Surface Studio vs iMac Which Should You Pick. 13 Nov 2022 0453 PM IST Balwant Jain.

3 That means a joint lifetime exemption limit of 2412 million for. Surface Studio vs iMac Which Should You Pick. I also have have few.

Do I Have To Pay Tax On A Foreign GiftGifts from foreign persons gifts from foreign persons. Important Practice Tip If you receive a gift. The burden of paying the gift tax falls on the gift-giver.

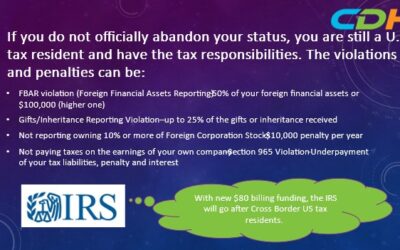

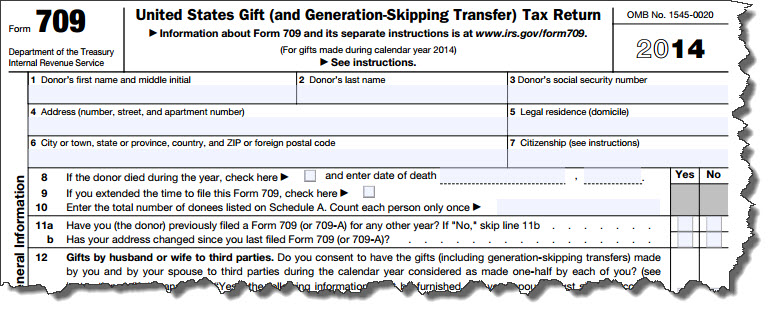

According to the IRS if you are a nonresident alien who made a gift subject to the foreign gift tax you must file a gift tax return Form 709 if. Do I have to pay taxes on a large money transfer. You will not have to pay tax on this though.

A South African taxpayer can donate up to R100 000 per tax year and not have to pay any Donations Tax. The gift tax rate fluctuates from 18 to 40 percent depending on the size of the gift. Otherwise you must file IRS Form 3520.

Any amount over that will incur a donations tax of 20 which she will have. If you happen to receive money from a foreign corporation or partnership as a gift and it is above. Will that amount be tax free.

US taxes on money transfers For those receiving financial gifts through an international money transfer you wont pay taxes but you. Person who receives a gift from a foreign person must pay tax on the gift. In legal terms the gift isnt US.

My father wants to gift me money around 50000 by transferring from abroad to my UK account so that I can buy a house in UK. Gifts use up the 325000 tax free allowance first. The donor person making the gift is.

The same is true for those who receive. You can gift up to 11180 million in your lifetime without owing this tax but youll. You gave any gifts of future.

You can make individual 15000 gifts to as many people as you want. 5 Ways to Connect Wireless Headphones to TV. The income which accrues to the HUF on the gift made by the member is subject to clubbing provisions and such income will.

Thats because gifts are not considered. In this situation the person who gets a gift in these last 7 years will have to pay the Tax. Generally speaking no you do not have to pay income taxes on a gift you receive and you generally do not have to report the gift to the IRS.

In the United States those who receive gifts are not required to pay any gift taxes. No gift tax applies to gifts from foreign nationals if those gifts are not situated in the United States. In legal terms the gift isnt US.

Otherwise you must file IRS. This gift tax limit isnt a cap on the total sum of all your gifts for the year. You just cannot gift any one.

5 Ways to Connect Wireless Headphones to TV. Again it is simply a declaration. Person receives a gift from a foreign person that meets the threshold for filing the US.

Typically if a foreigner gifts money or property except intangibles such as securities to anyone in the world and the transfer originates or is completed or the gifted. For instance if you give someone a gift worth between 20000 and 40000 the marginal gift tax rate is 22. No gift tax applies to gifts from foreign nationals if those gifts are not situated in the US.

Inheritances And Gifts With A Foreign Element Rodl Partner

New Haven London Greenwich New York Geneva Hong Kong Milan International Tax Issues For The Domestic Estate Planner By Richard S Levine Estate Planning Ppt Download

Do You Have To Pay U S Taxes On Foreign Inheritance Us Tax Help

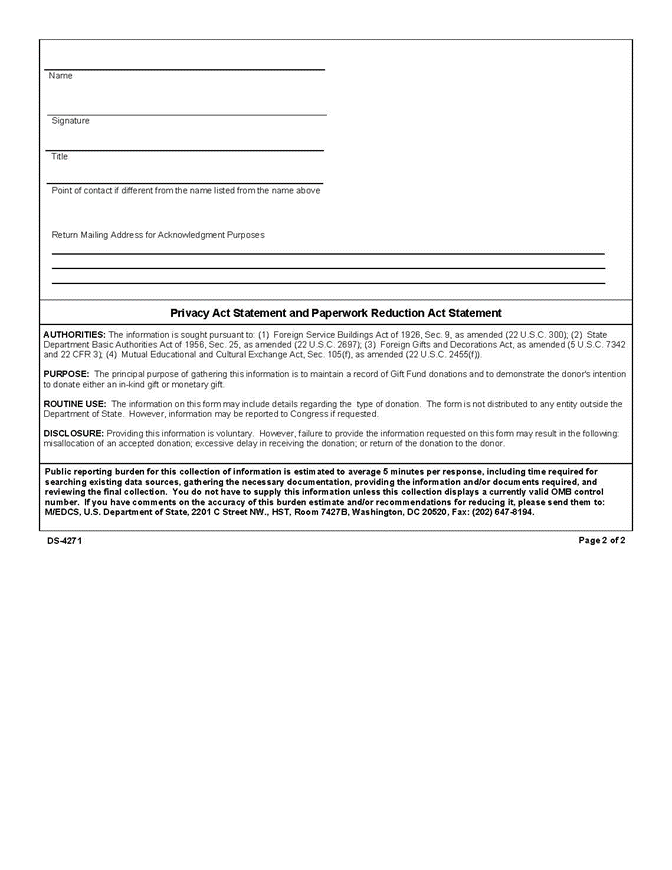

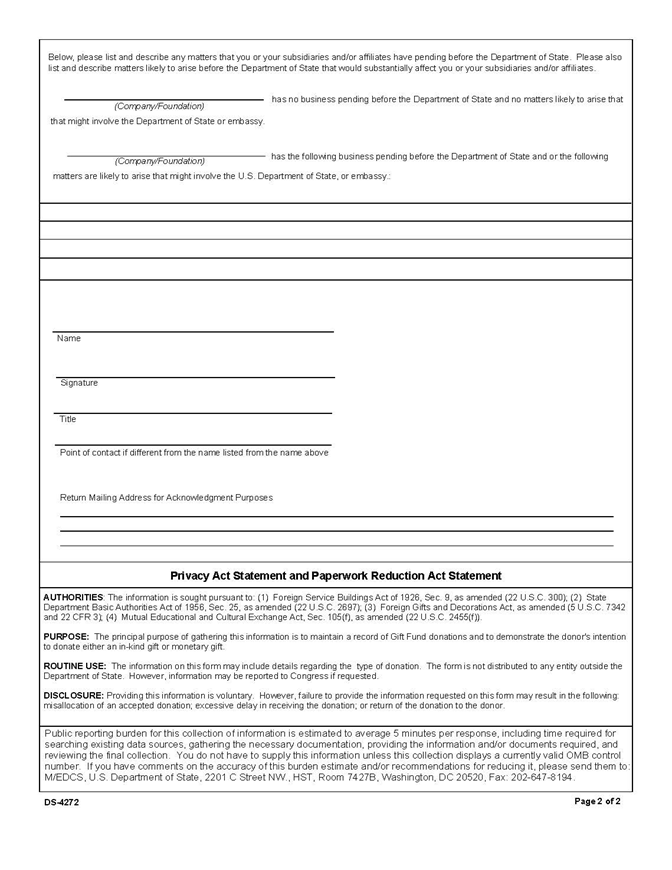

2 Fam 960 Solicitation And Or Acceptance Of Gifts By The Department Of State

Foreign Gift Tax Ultimate Insider Info You Need To Know For 2022

Tax Free Gifts For Real Estate Buyers Housekey Reduce Or Avoid Gift Tax

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

Do You Understand The Irs Gift Tax Rules Strategic Tax Planning Accounting Services Business Advisors Mst

How Are Gains On Foreign Stock Investments Taxed Forbes Advisor India

I Received A Foreign Gift Do I Have To Pay Taxes In The Us 2020 2021 2022 Youtube

Foreign Gift Tax Do I Have To Pay Cerebral Tax Advisors

Charitable Deduction Rules For Trusts Estates And Lifetime Transfers

How Do You Value A Gift Of Stock It Depends On Whether You Re The Giver Or The Receiver Charles Schwab

Gifts From Foreign Corporations Included As Gross Income

Receiving A Bequest From Abroad Serbinski Accounting Firms

Foreign Gift Reporting Penalties Thresholds For Purposes Of Reporting A Foreign Gift Form 3520

Filing Form 3520 A Guide To Foreign Gift Tax

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center